Spring 2022

The Quarterly Newsletter of Forethought Advisors

Our quarterly newsletter provides perspective, framing and political insight as we interpret the direction and objectives of Congress and the Biden Administration for CEOS and their corporate government relations teams. As experienced, seasoned government relations professionals, Larry Parks and Tim Simons recognize that corporate America operates effectively and efficiently in environments where they know what’s coming next - certainty. With insight, analysis, and some forecasting, we help our clients accurately evaluate the risks and political advantages during their campaigns to achieve legislative and regulatory objectives. Forethought Advisors provides the strategic leadership that can help propel our clients to the next level.

1 The Right and Wrong Ways to Battle Inflation in America

Lessons from America’s intermittent battles against rising inflation tell us that the most effective course towards improving long-term profitability for corporate America and enhancing quality of life for consumers lies with smart public policy at both the federal and local levels, including pro-business and pro-worker strategies. What the nation doesn’t need is monetary policy that seeks to lower inflation with a narrow approach relying on jarring interest rate hikes, which can send unemployment soaring and the private sector retreating from the types of investments that spur future growth for the nation’s economy.

More importantly, our policymakers must differentiate between the factors causing pandemic-induced temporary inflation, such as the supply chain delays around the globe, and those creating more damaging structural inflation. Neither scenario, however, is remedied by a knee-jerk response from the Federal Reserve that dramatically hikes interest rates.

Let us remember that when President Reagan and Paul Volcker’s Federal Reserve “won” their battle with inflation in 1982 unintended consequences spread around the globe. At the time, the causes of inflation were more distinctively structural than today. But the extreme interest rate hikes resulted in tight-money policies and unemployment rose, manufacturing in the Midwest suffered a 10% decline and the construction and auto industries nosedived. The net worth of the savings and loan industry deteriorated when their mortgage assets lost considerable value, leading to the industry’s collapse. A global debt crisis crippled economies around the world. That’s what an anti-inflation approach dominated by extreme interest rate hi0kes can do.

President Ronald Reagan and Fed Chair Paul Volcker

Interestingly, also at play with the economy is the Biden administration’s redefinition of what it means to be a pro-business government. For decades, corporate America clamored for Washington to keep interest rates low and deregulated – keeping regulators and bureaucrats out of their hair. Today, it is a much more complicated relationship between the public and private sectors. Government is making unprecedented resources available for companies to contribute to the public good, seeking to provide safe environments for workers during the pandemic and trying to ensure that our private sector economic engine keeps humming. How’s this for a surprise? The White House invited CEOs inside their security bubble to share cybersecurity intelligence and discuss how to respond to possible Russian attacks on America’s systems, networks and programs. Clearly, a new government-corporate partnership is evolving.

What’s encouraging in the inflation fight, even with a deeply polarized electorate, is the innovative public policy thinkers in play. It starts at the top with President Biden, who remarkably isn’t given much credit for his administration’s creative, pro-business policies that have put unprecedented resources on the table for companies. Further, President Biden recognized the vulnerability of the corporate reliance on supply chains. His answer to the supply chain debacle, even before it became a full-blown crisis, had a strong pro-business element. He encouraged American companies to build their products at home rather than in China and other low-wage countries, which would put more American-made goods and products stored in warehouses so they are closer to the consumers who need them. Clearly, if companies stockpiled more goods and products, the dependence on supply chains would drop, putting more goods and products on grocery and other store shelves and helping to ease inflation.

McKinsey & Company says in a study “the complexity of global industrial supply chains exponentially increases their risk.” Across the globe, everything from natural disasters to armed conflicts and trade tensions can disrupt supply chains. Not to mention the interruptions caused by the pandemic. The stakes are high for the corporate community. Companies unable to manage disrupted supply chains are at high risk, even more so if they are powerless to mitigate the frequency of the shocks. Even a short disruption of 30 days or fewer can put 3% to 5% of EBITDA1 margin at stake. Each decade, up to 45% of one year’s EBITDA is lost to companies because of supply chain disruptions, according to McKinsey & Company’s Reimagining Supply Chains study.

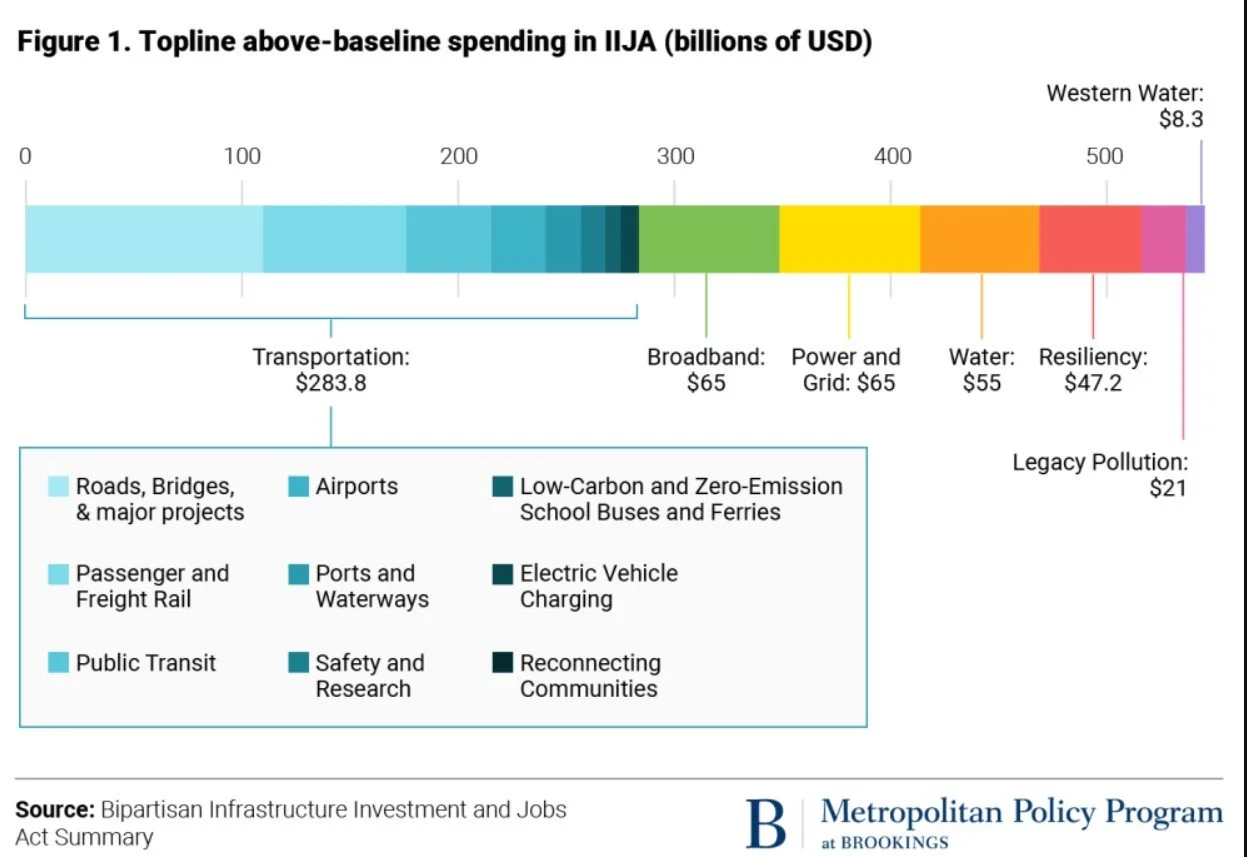

Perhaps lost in the political haggling over the infrastructure legislation, the $1.2 trillion bill is an example of pro-business policy that includes significant measures to boost U.S. manufacturing. It requires that state and local governments use domestic sourcing for construction materials in federal public works projects, while also imposing new domestic standards for goods and construction materials that the federal government itself purchases. Or put another way: essential federal financial assistance for infrastructure projects will be eliminated unless all of the iron, steel and manufactured products and construction materials are American made. The impact is being felt in local communities. Rep. Terri Sewell, D-Alabama, said in February that Alabama has added 5,500 manufacturing jobs. Specifically, he cited the American Rescue Plan and the Infrastructure Investment and Jobs Act for helping these manufacturers create and restore jobs.

The trade-off is that while federal regulations and resources fuel business expansion and create new jobs, the private sector may pay higher costs for employee wages and benefits than if they were making their products overseas. But pros seem to outweigh the cons. It eases the burden on supply chains, while helping companies grow at home.

The pro-business policy making doesn’t stop there. With the Build Back Better legislation, the President wants the resources deployed to address Climate Change to also spur a new phase of industrial revolution here at home. Clean energy technology is at the heart of his effort - wind turbine blades, solar panels, electric cars and more - will be built in the U.S. with domestic steel and other materials, creating hundreds of thousands of good-paying jobs. Furthermore, the plan is to use grants, loans, tax credits, and procurement to drive capital investment in the decarbonization and revitalization of U.S. manufacturing. This will boost competitiveness of U.S. steel, cement, and aluminum industries.

Even on the local level innovative ideas are being put into action. New Boston Mayor Michelle Wu is using $8 million of federal relief funding to expand free bus routes in low-income communities in the city. Think about the possibilities. If free transit was available more widely, it would reduce the demand for used cars and gasoline, blunting price increases in two of the main areas contributing to rising inflation. And, of course, it would have a positive impact on Climate Change and the environment. Furthermore, lowering or eliminating mass transit fares can help businesses by serving as an incentive for employees to return to work.

There are plenty of innovative ideas that can be scaled to help in the fight against inflation. It was surprising to many that rent prices are escalating. Already, Treasury is allowing unused rental assistance funds to be redirected to assist struggling landlords, which in turn, helps low-income families stay in their housing units. But what if those funds came with conditions placing limits on future rent increases? That would be using smart public policy to assist consumers and businesses, while helping keep inflation in check.

The nation needs an environment where both corporate America and consumers can thrive. That isn’t created if monetary policymakers put on blinders and see escalating interest rates as the only meaningful tool against inflation. Pro-business polices are providing new access points for corporate America, ways that funds can be accessed to grow businesses and create jobs. There are new ways to securing the future for many businesses, and making up for COVID-related losses, by taking advantage of these access points, resources and opportunities that these pro-business policies make available. To-be-sure, this is a new era, a new covenant is being forged amongst corporate America, policymakers and consumers. Finding common ground is benefiting all parties.

Today, there are advanced pathways and access points in place that can build economic success for businesses. Our team at Forethought Advisors helps clients navigate this new environment. Or, we can help pave new legislative and regulatory paths that will lift your business. With keen insight into the C-Suites, public policy circles and consumers, Forethought Advisors helps our clients advocate for pro-business policies and smart consumer policies and engage with the existing ones.

2 The 2022 Midterm Elections: Which Policies (if any) Will Drive the Politics

Eight months away from voters casting ballots, it’s an open question how much public policy issues will be a driving force in electing a new Congress. Not long ago, domestic, and at certain times, even foreign policy greatly influenced the outcome of congressional elections. In 1994, for instance, Republicans introduced its Contract with America, a new conservative policy doctrine, and the GOP derailed First Lady Hillary Clinton’s efforts to overhaul the nation’s healthcare system. The result was a pickup of eight Senate seats and 54 House seats, which gave Republicans control of Congress for the first time since 1952.

In today’s fractured Washington, much has changed: public policy seems to routinely take a backseat to culture wars, disinformation campaigns and attacks on whatever fresh ideas are presented - rarely are there comprehensive policy debates. In fact, Senate Minority Leader Mitch McConnell already acknowledged that he won’t have a legislative agenda before the midterm elections. And when Florida GOP Sen. Rick Scott unveiled an 11-step “Plan to Rescue America,” it was roundly debunked (raising taxes on low-income Americans and seniors is a nonstarter across the political spectrum), even by some in his own party.

But for the corporate community, policy is still what should matter most. While it may have diminishing impacts on election outcomes, public policy certainly can influence the bottom line for corporations, as well as the success of local and community businesses. The congressional and executive branch guidance to policymakers and regulators shapes future decisions, business models and investments for a wide array of companies.

In Washington, it’s critical that corporate leaders understand the nuances of power, that they have an understanding of the players and the maneuvering behind the scenes so they can manipulate influentials and the processes to benefit their companies. C-Suites must be able to gauge which public policies could possibly breakthrough the noise and influence the election, and why or why not they did so. Forethought Advisors is well position in both political and policy circles to provide that information and allow executives to make informed decisions about their future.

What we provide goes above and beyond the intel received from the trade associations operating along the city’s power corridors.

First, however, an examination of the 2022 playing field is needed. Redistricting has altered the battleground, leaving the number of contested congressional seats near its lowest mark in 30 years. Specifically, the New York Times estimates that fewer than 40 seats out of 435 may be considered competitive seats, a remarkable decline of 33 competitive seats since the 2012 election cycle. Here is how that change influences the races: besides nearly guaranteeing that one party or the other wins the seat, the new district lines reshape the political landscape for the candidates. Suddenly, the most important contests are in the primaries not necessarily the general elections. That creates scenarios where the candidates are most likely playing to their party’s base voters on the left or right fringe, rather than to moderates in the middle who might hold sway in a competitive general election. Thus, any policy proposals will follow the same path – the objective will be to create support from primary voters at the poles, not in the center.

Traditionally, the party of the President usually loses seats in the midterm elections. The Democrats only have a five-seat margin in the House, leaving Republicans with history on its side and only a little ground to make up. In describing the horse race, the non-partisan Cook Report said Democrats are defending eight "toss-up" districts across seven states, with five of those either leaning or likely Republican. In addition, Arizona's 6th District (open seat), New Jersey’s 7th (Rep. Tom Malinowski), and Texas’s 15th (open) are Democratic seats that are leaning Republican. Moreover, two toss-up Democrat seats — Arizona's 2nd District (Rep. Tom O'Halleran) and Michigan's 10th District (open) — are currently in the "likely Republican" column. Republicans are defending six toss-up seats in four states, with only Illinois' 13th (open) currently leaning Democratic.

Sen. Chuck Schumer

Against this backdrop, President Biden and Democrats will seek to be judged by their ability to enact legislation, including the landmark infrastructure bill that encourages American companies to manufacture goods and products at home. Their polices are also shaped to enhance the quality of life for low-income and middle-class Americans, while addressing the inequities in our society. The infrastructure bill ga ve Democrats a win on paper, but the pro-longed fight over the legislation seemed to dampen the political impact – it didn’t give President Biden or Democrats much of a boost. Nor did the bi-partisan bill provide much of a lift to the Republicans who supported or opposed it.

One factor working against public policy ideas playing prominent roles in campaigns is the make-up of today’s voters and where they get information. The digital revolution has opened the airwaves and internet to conspiracy theories and out of the mainstream views that nevertheless influence how people vote. The non-profit, nonpartisan Public Religion Research Institute (PPRI) specializes in research and polls on political issues and their influence on religious values. Their polling found that about 25% of Republicans believe in QAnon and its conspiracy theories, including its outlandish accusations about the people running the government. Moreover, PPRI research also found that 60% of Republicans believe that the election in 2020 was stolen from former President Trump.

The key to the impact will be the implementation. Thus far, the administration has done a poor job of articulating its broad impact. For instance, Transportation Secretary Pete Buttigieg has focused on electric vehicles rather than talking about the billions that will be spent on mass transit and repairing streets, highways and bridges, as well as the funding for badly needed new infrastructure and the jobs all this work will create. That is what voters will likely care more about, especially in the key states of like Wisconsin, Ohio and Michigan. Unless the administration focuses on the meat and potatoes it could be another in a long list of missed messaging opportunities for Democrats to make their case to the American people.

Next up for Democrats will be trying to salvage parts of the original Build Back Better legislation. Maneuvering has largely been between the progressive and moderate wings of the party as two centrist Democrats, West Virginia Sen. Joe Manchin and Arizona Sen. Kyrsten Sinema, have withheld their support of the measure that would revamp many of the nation’s social programs. The legislation can’t be enacted without their support in the reconciliation process, but pressure will be mounting: Democrats will desperately want to pass some parts of the legislation to galvanize their voters and get them out in the fall. It will likely be their last chance to bolster the public’s view of their leadership before the elections. Can Democrats emphasize the child tax credit, lowering cost of prescription drugs, affordable housing initiatives and other components popular with voters?

Republicans have strongly opposed the legislation, with some raising concerns about whether the spending will further fuel inflation. But after President Trump’s tax cutting and spending spree resulted in a nearly $7.8 trillion increase in the national debt, the GOP may have trouble selling the fiscal restraint arguments. In December, 437 companies, investors, trade groups, and employers expressed support for the climate investments. Economists estimate the legislation, if enacted, would add 1.5 million new jobs annually, and the GDP would rise by $3 trillion.

With the Russian invasion of the Ukraine, the fallout in the U.S. and the noise from nonconsequential issues, Democrats will be challenged to make their policy agenda work on their behalf in the fall election. But for the corporate world, the challenges are far different: business leaders should ensure that they are being thoroughly informed on the measures that can have significant ramifications for the future of their companies.

Regardless of the outcome on the political battlefields, public policies will always matter for American’s business community. What also is critical is how these policies are implemented by the administration’s regulators and policymakers. Forethought Advisors stands with our CEOs ensuring that they have information on how the policies are actually being executed so they can chart a course forward for their businesses.

3 A New Round of Financial Services Issues Breaking out of the Shadows

It’s an election year, with a divided Congress and an administration that has already pumped trillions of federal dollars into the economy. Historically, that’s the formula for lots of rhetoric and not must more action. But could 2022 be different?

War rages in the Ukraine as daily visuals of apartment buildings, schools, malls and other aspects of an eastern European society are destroyed, and men, women and children are brutally killed in the Russian onslaught. President Biden, his foreign policy and defense teams, as well as Capitol Hill lawmakers navigate pathways to support the Ukrainians without riling Russian President Vladimir Putin to the point that it sparks a broader confrontation that could lead to World War III. At home, the federal government steadfastly tries to set a course that can protect Americans from any new waves of COVID-19, while the country returns to its normal social and work patterns. Within government complexes, workers adjust to reappearing in offices after months of performing their jobs from home because of the pandemic.

With this backdrop, time marches on. The government’s focus will remain on the war and the pandemic, but other domestic and regulatory issues are looming and their outcomes will have substantial impact on corporate America and our society. Moreover, just as it has in the past, war itself may trigger some unusual partnerships as well as policy decisions and legislation that normally wouldn’t see the light of day. With a need to replace Russian oil, does the United States mend the fences with Venezuela and make a grab for their oil? Does the Biden administration dare to push for price controls to limit price increases on a range of goods and services while inflation rises? Will tapping the nation’s oil reserves bring inflation relief?

Regardless of how busy lawmakers and policymakers will be with the war and pandemic, other critical issues, too, must be addressed by Congress and the administration in the coming weeks, and months. With contacts on Capitol Hill, in the administration and in influential think-tanks, Forethought Advisors is well positioned to identify issues and scenarios poised to take centerstage and work with CEOs and C-Suites at shaping legislative and regulatory measures that will help maximize the success of their companies, businesses and organizations.

What’s up next?

As Rahm Emanual, the pol and operative turned Ambassador to Japan, once put it during the Great Recession: “You never want a serious crisis to go to waste. And what I mean by that is an opportunity to do things that you think you could not do before.” That could translate to any number of changes in the financial services sphere if that sentiment tips the equation towards taking actions that have been looming in the background.

Banking regulators for years have sought ways to bring FinTechs under their tent as financial technology companies gain larger shares of the traditional banking sector. Now, the ground is shifting at the Federal Reserve Bank.

After resisting the need to regulate FinTech over concerns that the companies would bring too much risk to the banking system, the Fed is poised to review approaches to regulating FinTech. In turn, the FinTech companies are not being passive: they want to access the Fed’s payment system, a process providing electronic money exchanges of between banks and other depository institutions. In early March, the Consumer Bankers Association (CBA) maintained that if FinTech companies are going to offer banking products, they must be regulated as banks. CBA is calling for the rapidly expanding industry to follow the same rules as federally supervised financial institutions. Further, the trade association called on Congress and regulators to “move swiftly” to ensure a level playing field between the relative newcomers and traditional retail bankers. As interest rates rise, the great unknown is how that will impact FinTech companies that have been fueled by low interest rates and their growing share of the mortgage market.

Ambassador Rahm Emanual

Yet, the most contentious issue may be how the Community Reinvestment Act (CRA) applies to FinTech companies, if at all. Enacted in 1977, CRA coerces regulated financial institutions to invest in the communities where they are located and serve. With regulated banking institutions spending millions a year abiding by CRA regulations, they want FinTech companies to have the same obligations so traditional banks aren’t at a competitive disadvantage. Even more heat will likely come from social justice advocates who feel under-resourced communities are further disadvantaged because FinTech companies are not following the CRA guidelines on giving back to the communities where they operate. Progressives will see it as an opportunity to extend the reach of CRA. Expect FinTech to argue that their services brought to consumers at better pricing than traditional financial institutions are their contribution to these communities.

Federal Reserve Bank

Meanwhile, an issue quickly rising to the surface is how to compensate consumers who have been victimized by scams and fraud on Zelle, the popular payment platform owned by America’s largest banks, and similar programs, that enable person-to-person instant money transfers. In 2021, consumers moved $490 billion through Zelle, and another $230 billion through Venmo, the second largest service. But in 2020 alone, 18 million consumers using Zelle and other digital wallets were defrauded. Already, there is growing anxiety in banking circles over a guidance issued by the Consumer Financial Protection Bureau (CFPB), which told banks they must reimburse customers when their programs are hacked and money is transferred by people other than the consumer. The upcoming debate will also center around whether the banks can be forced to repay consumers when they were tricked into authorizing payments that turned out to be fraud. Complicating the issue is the fact that Zelle is owned by the Big Banks, who are regulated by the FDIC. Should their offshoot service face the similar requirements when it comes to fraud?

It will be a high-stakes issue for Congress and the CFPB to sort out. Clearly, lawmakers will be heavily lobbied by consumer advocates on one side and the financial service institutions and banks on the other.

As gas prices soar above $5 a gallon because of inflation and repercussions of the administration’s decision to stop purchasing Russian oil, President Biden is under pressure to re-examine his executive order from a year ago that killed the Keystone XL oil pipeline project. Specifically, shortly after taking office Biden handed a victory to his environmentalist supporters by revoking cross-border permits the pipeline needed to continue. The pipeline was designed to transport oil from Canada through the Midwest to refineries in Texas. Even though banning Russian oil imports is very popular, the narrative of the president derailing a project that would boost domestic oil production, and potentially lower gas prices, is an unpopular portrayal in the current climate. A poll by Maru Public Opinion found that 71% of the respondents favor Biden issuing a new executive order greenlighting the project. If Biden had not stopped construction of the pipeline, it would have begun importing oil early 2023.

Another pressing issue will be whether the administration and Congress agree to lower the prices at the gas station pumps for consumers. In February, Rep. Josh Harder (D-CA) introduced legislation in the House called the Gas Prices Relief Act of 2022 that would suspend the 18.4 cents per gallon federal gas tax for the rest of the year. His legislation would seek to ensure that the savings are passed on to consumers by requiring the Treasury to monitor pricing by the oil and gas companies. Senators Mark Kelly (D-AZ) and Maggie Hassan (D-NH) introduced similar legislation in the Senate.

But that move comes with pros and cons. The gas tax, which has been set at 18.4 cents per gallon since 1993, is the primary source for funding repair work on highways, roads and bridges. Some lawmakers may not want that work interrupted.

Answers to all these questions, as well as others, will be coming soon.

4 OUR BIG IDEA: Reward Corporations for Helping Create a New Social Contract With Their Employees

For all his controversies, President Donald Trump understood that American families are enduring a mobility and stability crisis. For generations, the objective was to help your family reach the middle-class plateau, and then put the next wave on a path to do even better. Union jobs created options for high school graduates, and even dropouts, to make a living wage and find a way on the upward trek towards middle-class. But so many things have changed. Technology has eliminated a number of jobs, replacing them with computers and digital solutions. Labor unions and their respectable pay grades and benefits, have shrunk.

Instead of upward mobility, too many families today fear “backwards mobility,” as they join the bottom 50% of Americans with negative net worth. Even more telling is the stunning statistic that only 17% of the country’s wealth now belongs to middle-class families.

While President Trump identified these trends and won an election because he was able to articulate them to voters, President Joe Biden has taken the next step and developed an agenda that seeks to bring financial and emotional security to working-class and middle-class families. He hopes to lift the middle-class. His proposals empower the private sector to sustain and create quality jobs for those who aspire to be in the middle-class. Further, he does it by linking job creation to the need to limit climate change and modernize America’s systems and networks. Biden is proposing and enacting legislation aimed at creating a new social contract between the people and their government. President Johnson ushered in the Great Society era in 1965-65 by transforming the nation with unprecedented spending on healthcare, education, urban cities, transportation and rural poverty. Biden’s agenda takes a similar approach. It is framed around investments boosting America manufacturing, creating quality jobs and enhancing the quality of life for the middle-class and the poor. Or as the President puts it: building the economy from “the bottom up and the middle-out.”

Lawrence Parks

Timothy Simons

In so doing, Biden is putting federal dollars on the table for corporate America to invest in cleaner energy, produce goods and products at home and repair the nation’s highways, roads and bridges and build badly needed new infrastructure.

This is how the White House describes the infrastructure legislation:

“This Bipartisan Infrastructure Law will rebuild America’s roads, bridges and rails, expand access to clean drinking water, ensure every American has access to high-speed internet, tackle the climate crisis, advance environmental justice, and invest in communities that have too often been left behind. The legislation will help ease inflationary pressures and strengthen supply chains by making long overdue improvements for our nation’s ports, airports, rail, and roads. It will drive the creation of good-paying union jobs and grow the economy sustainably and equitably so that everyone gets ahead for decades to come. Combined with the President’s Build Back Framework, it will add on average 1.5 million jobs per year for the next 10 years.”

But here at Forethought Advisors we believe the Biden approach is just half the equation. The next step, this quarters Big Idea, is to make the public sector a partner in transforming America. There needs to be a new social contract between workers and employers.

By all accounts, the pandemic expediated the corporate world’s use of automation and technology as many human workers stayed home. That acceleration will continue. While some jobs will be eliminated, the new technology will also result in millions of new jobs. It will create opportunities for employers to re-establish the relationship with their workers.

For instance, what tax incentives can be enacted that encourage companies go back to training their workers for the jobs coming online in the future. Companies shouldn’t be outsourcing the training, depending on community colleges to prepare their workforce. Companies are in a better position to give workers the training they need to succeed. More extensive employer training would bond workers closer to their companies, returning to an era when workers showed more loyalty to their employers.

This approach may require a shift in the board rooms. There may be too many companies where the boards are overly influenced by investors interested in short-term success. The investors seeking quick returns on their investments with little interest in the long-term success of the company or developing a strong relationship with the workforce. And, it might not be a bad idea for boards to have more labor representatives in the room as long as there is a demonstrated commitment from all for the long-term success of the company.

Board rooms with this structure might be willing to entertain innovative ideas on developing strategies that lift company profits and boost the morale of the workforce.